how to calculate cash flow from balance sheet

Balance sheet cash flow measures the. Its based on the accounting equation where assets equal.

Cash Flow Statement Overview Indirect Vs Direct Method For Operating Cash Flow Calculation Youtube

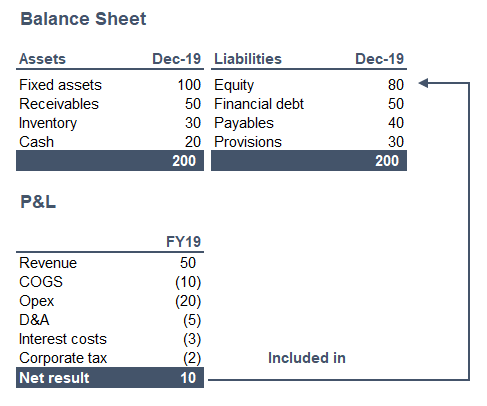

Non-cash items also count while calculating net income in an income statement or assets and liabilities in a balance sheet.

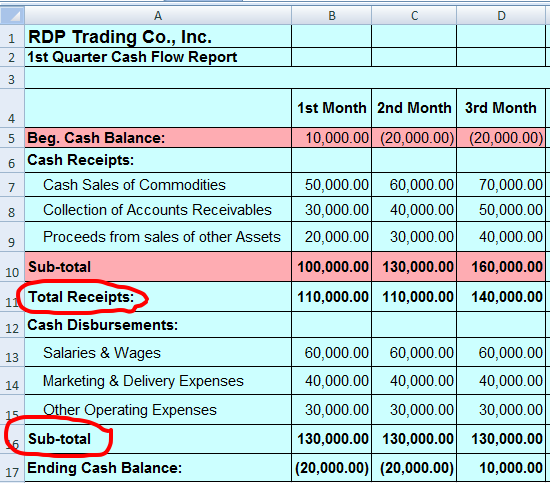

. Cash-flow is the oil which drives a banks engine and helps us determine if the motor running a bank is sufficiently lubricated or not. You calculate cash flow by adjusting a companys net income through increasing or decreasing the differences in credit transactions expenses and revenue all of which are. Unlike the balance sheet only cash-effective postings are taken into account when calculating the cash flow.

The Net Cash Flow from one statement to another should represent the. In this example assume the company shows 200000 in. - Experience creating a.

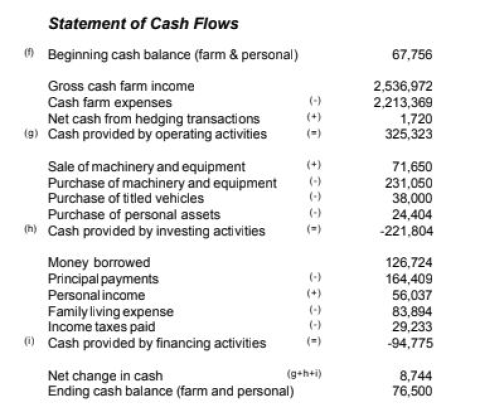

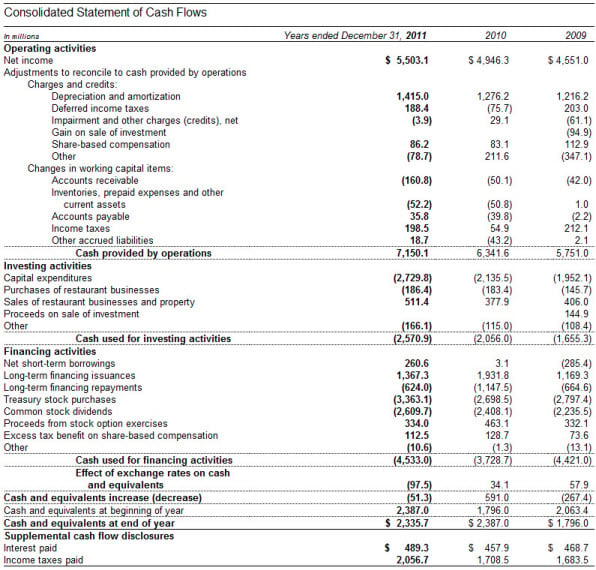

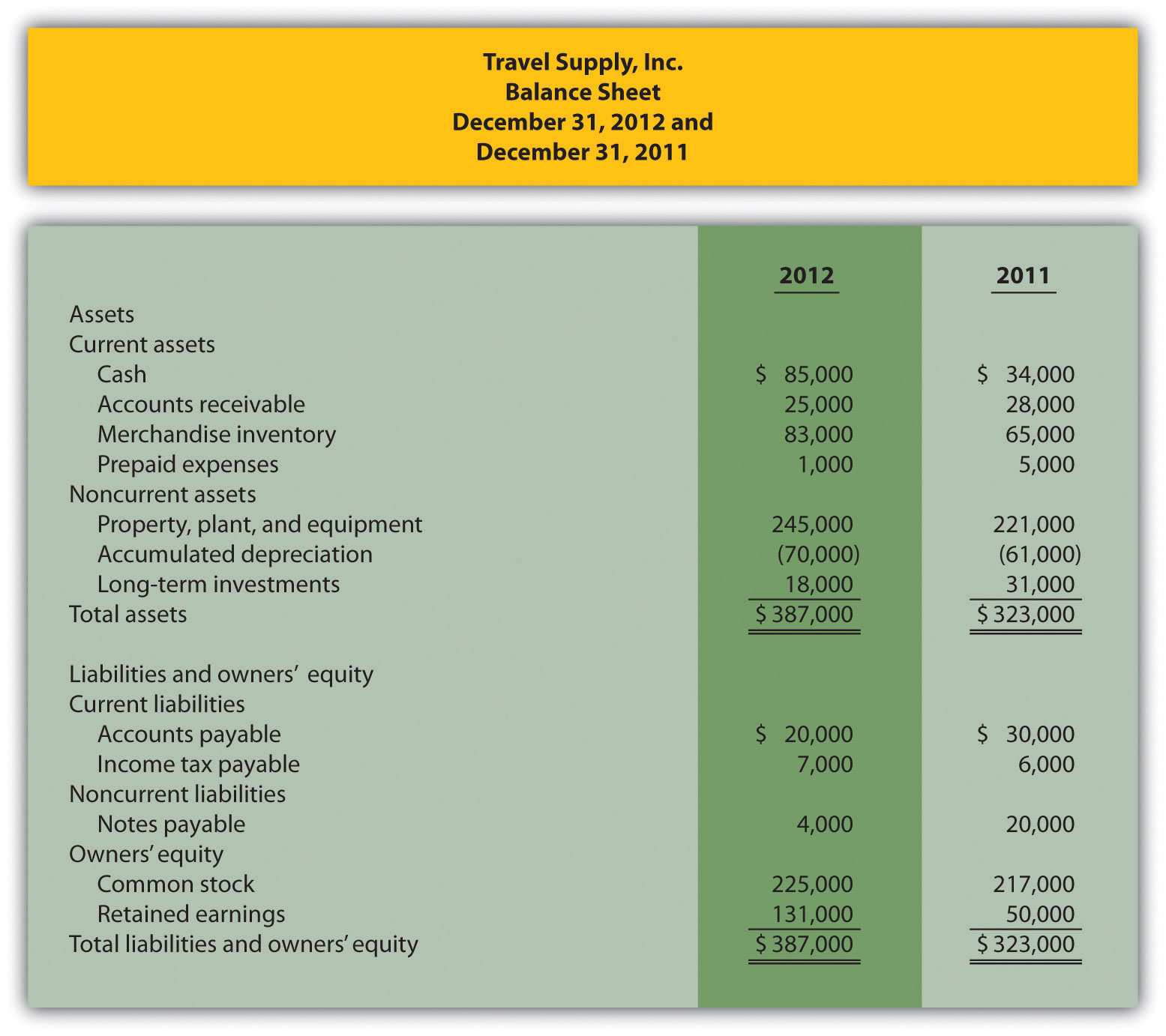

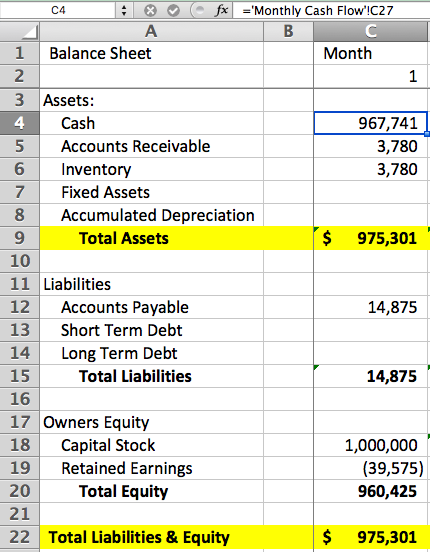

The cash flow statement is linked to the income statement by net profit or net loss which is usually the first line item of a cash flow statement used to calculate cash flow from. Double-entry accounting is the foundation of modern financial accounting. In order to prepare a cash flow statement you will need to reference two balance sheets a complete income statement and know some additional information.

With the balance sheet take two cash flow statements into account for the current year and one for the previous year. Cash flow for non-cash items is calculated by adjusting the. Besides we need to include the cash.

Firstly determine the operating income of the. To prepare the cash flow from Financing we need to look at the Balance Sheet items that include Debt and Equity. It is built based on the information recorded on your income statement.

With the indirect method cash flow is calculated by adjusting net income by adding or subtracting differences. The non-cash postings on the other hand are to be excluded. Step 3 Find the amount of the companys total current assets listed at the bottom of the Current Assets section of its balance sheet.

Calculate Cash Flow from Financing. Calculating the changes in non-cash net working capital is typically the most complicated step in deriving the FCF Formula especially if the company has a complex. A cash flow statement displays how much actual cash is moving in and out of your companys accounts.

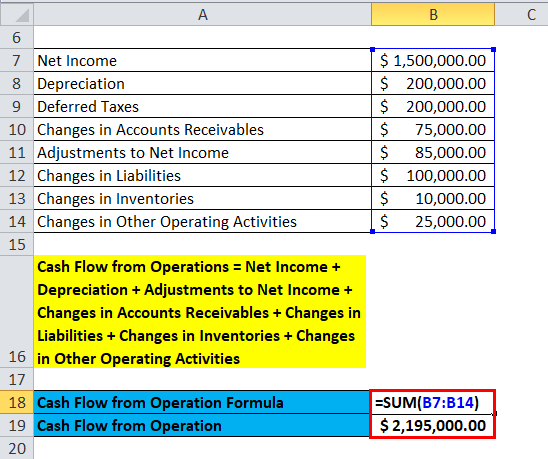

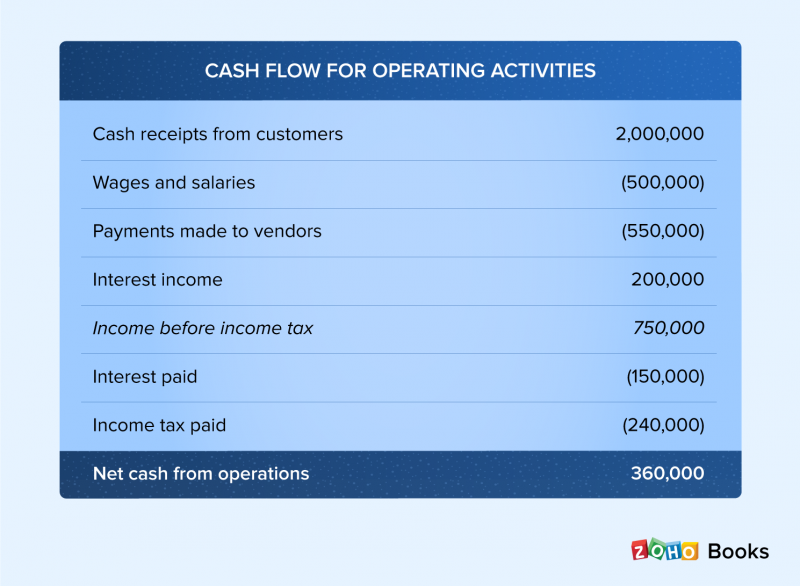

How do you calculate cash flow from balance sheet and income statement. This first step is to use the two balance sheets to calculate the change in each account by subtracting the beginning balance from the ending balance. The formula for operating cash flow can be derived by using the following steps.

Cash Flow From Operations Formula Calculator Excel Template

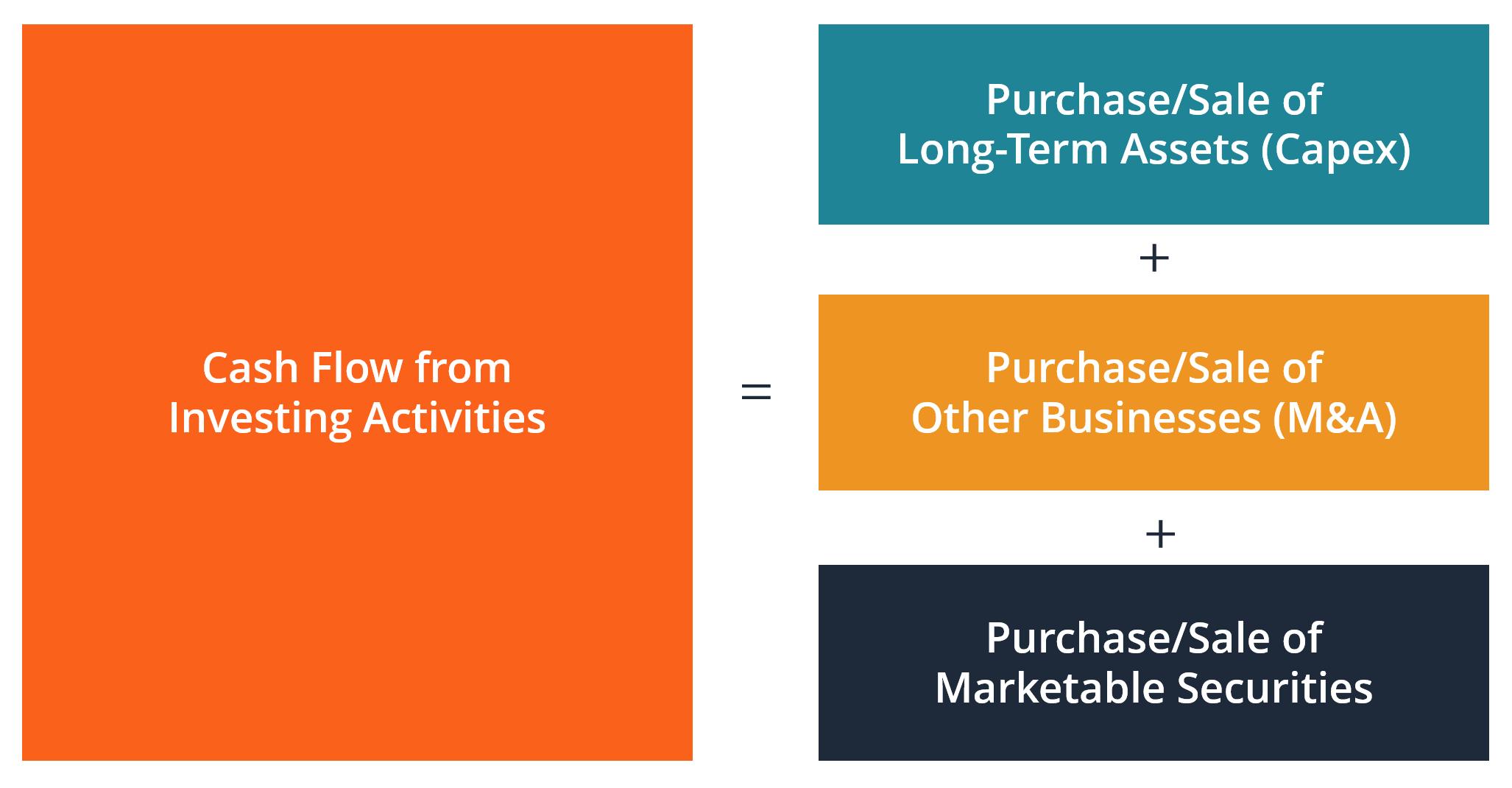

How To Calculate The Cash Flow From Investing Activities

Net Cash Flow How To Calculate Vs Net Income Importance Analysis

How To Prepare A Cash Flow Statement Model That Balances Toptal

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Explained Types And Examples

Appendix Using The Direct Method To Prepare The Statement Of Cash Flows

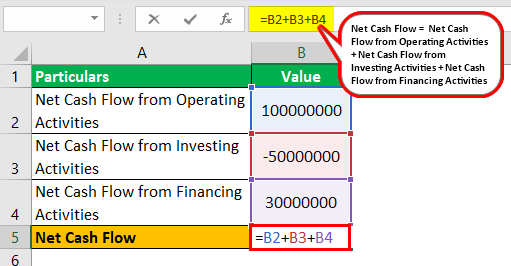

Net Cash Flow Formula Calculator Examples With Excel Template

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

Cash Flow Statement Explanation And Example Bench Accounting

Cash Flow Report Process Street

How To Calculate Cash Flow For Your Business Direct Vs Indirect Cash Flow Zoho Books

How To Prepare A Cash Flow Statement Model That Balances Toptal

Startup Financial Modeling Part 4 The Balance Sheet Cash Flow And Unit Economics

What Is Free Cash Flow And Why Is It Important Example And Formula Article

Easy To Use Cash Flow Statement Template Monday Com Blog

:max_bytes(150000):strip_icc()/InvestoApple2jpeg-da0c6b0acbc7478d9df0caf561ad0afc.jpg)

Balance Sheet Vs Cash Flow Statement What S The Difference

Net Cash Flow Formula Step By Step Calculation With Examples

Cash Flow From Assets Definition And Formula Bookstime

Cash Flow From Investing Activities Overview Example What S Included